Real-time lending refers to the automated credit decisioning and funding of loans online - often instantaneously. The backbone of real-time lending is technology that allows banks to digitize their credit policies and underwriting processes while providing customers with a convenient online application experience.

Real-time lending transforms traditional execution of loans by leveraging data science and intelligent automation. What once took weeks of manual front-office selling and back-office underwriting can now occur in a matter of minutes with real-time lending. Ultimately for banks, real-time lending generates greater profitability and attracts new customers for ongoing growth.

The benefits of real-time lending for banks are strategic and compelling across stakeholders:

- Power Operational Efficiency and Cost Savings: Manual credit policy execution can take weeks of costly front- and back-office time and resources. Real-time lending executes credit policies in minutes—all without sacrificing a bank’s unique credit policy parameters, risk management and compliance standards.

- Transform Business Lending into a Growth Driver: The same amount of resources and costs are required to close a $50K loan as a $500K loan with traditional lending. Real-time lending both removes significant costs and increases pricing, transforming small business lending into a lucrative business for banks.

- Control Credit Policy Decisioning: Real-time lending ensures uniform credit decisioning across the portfolio without without inconsistency or human subjectivity, all while providing credit managers the flexibility to make changes to that policy in shifting economic environments.

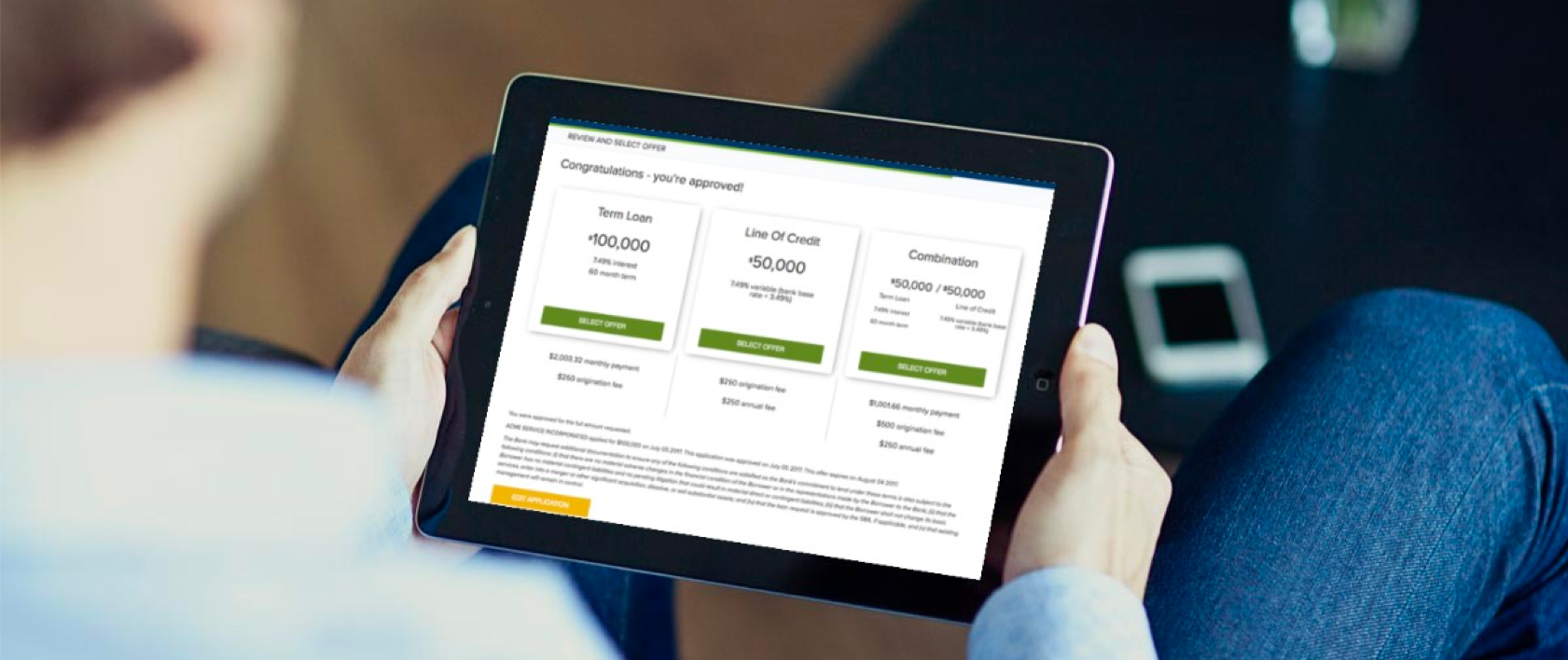

- Meet On-Demand, Digital-First Customer Expectations: Digital access is now table-stakes for banks, and on-demand services are transforming nearly every aspect of business and consumer life. Real-time lending allows businesses to secure financing anywhere, anytime, in a matter of minutes.

- Attract the Highest Lifetime Value Customers: Millennials are the largest potential lifetime value segment for banks; they grew up with the power of the Internet and increasingly expect services on-demand. Real-time lending attracts this new generation of entrepreneurs, establishing a foundation as long-term customers.

- Empower Bankers to Go Omnichannel: Real-time lending powers more than just online applications. From face-to-face and over-the-phone conversations to remote visits, bankers can walk businesses through the online application process to speed loan funding from weeks to minutes.

- Differentiate in an Increasingly Crowded Market: An increasing number of alternative financing options are available for businesses to choose from. Local banks can couple advantages inherent in their community relationships and high satisfaction scores with real-time lending’s convenience and speed for defensible differentiation.

Banks are increasingly adopting real-time lending to win business customers, expand business customer relationships, and grow market share. Learn more about the real-time lending opportunity here.