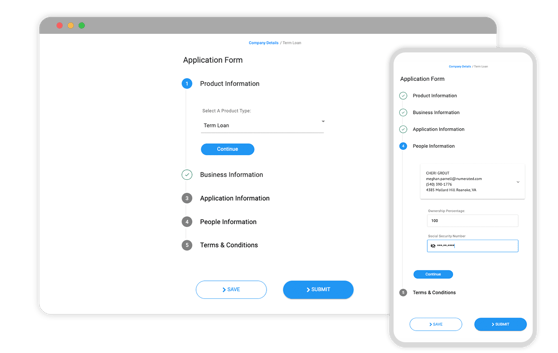

Make it easy for businesses to apply for any product, anywhere, anytime

Go beyond static web forms and put Numerated's data science to work to create pre-filled digital application experiences across the bank's full suite of business banking products.

Numerated's digital application solutions support business deposit accounts, term loans, lines of credit, SBA loans, overdraft protection, credit cards, equipment financing, owner-occupied commercial real estate, working capital lines, and more.

Pre-Filled Applications

Leverage core data and rich third-party data integrations with the Secretary of State, LexisNexis, IRS, public filings, and more to identify businesses, pre-populate applications, and dramatically reduce the application work required by borrowers to apply for bank products.

Omnichannel Support

Allow businesses to choose where, when and how they apply with support for both self-service and banker-led customer journeys across bank channels. In self-service journeys, bankers remain informed of application progression with progress queues and notifications.

Validated Data

Benefit from artificial intelligence that validates application data across multiple sources for a single view of the business, including solving for differences in Secretary of State registration data, the businesses’ website, and the bank’s core data.

Bundled Products

Support advanced customer journeys that involve multiple products to avoid requesting the same information from customers twice, including embedding business deposit account opening applications within loan applications.